N26 You

Your international bank account for travel and everyday life

Looking for the perfect account for day-to-day life and travel abroad, all with no hidden fees? Then you’ve found it with N26 You — the travel account from N26. Open your international bank account today and get an N26 debit Mastercard in your choice of five stylish colors.

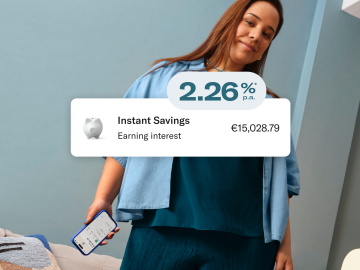

Start earning interest

No deposit limits,* simple conditions, and full flexibility. Discover N26 Instant Savings, the easy-access savings account available at no extra cost in the N26 app.

N26 You customers get 2.26% p.a.** interest on their savings.

More about the Instant Savings account

Free trades every month

With N26 You, get 5 free monthly trades for stocks and ETFs. It’s the simple way to invest in your future without having to leave your banking app.

Discover Stocks and ETFs

*The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

**The interest rates vary based on your membership: 4% p.a. for Metal, 2.26% p.a. for You and Smart, and 1.26% p.a. for Standard accounts. Please note that regular rates per membership are subject to change over time.

Manage your money with Spaces sub-accounts

Stay on top of your finances with 10 Spaces sub-accounts, each with its own IBAN. Easily pay bills via direct debit, set up standing orders for recurring payments, send SEPA bank transfers, and receive money — right in each sub-account.

Keen to save instead? Instantly put money aside to a Space from your main account to avoid spending it, or save together with up to 10 others in a Shared Space. To reach your goals even faster, turn on Round-Ups and save the spare change whenever you pay by card.

Discover SpacesPay via card from your Spaces

Want to spend directly from a Space and save the hassle of transferring money back and forth? Simply link your N26 debit Mastercard to one of your Spaces in seconds. It’s fast, simple, and gives you even more control over your spending.

Sort your income into Spaces

With N26, you can automate your budget easily with Income Sorter. Automatically move either a percentage or a fixed amount of your incoming funds to one or more of your Spaces. Saving has never been so easy.

Fee-free ATM withdrawals and payments in foreign currencies

Forget foreign transaction fees for good. Withdraw cash for free in any currency from ATMs around the world, and pay using your N26 You debit Mastercard online and in stores with zero fees. You’ll also benefit from the Mastercard exchange rate, without any markups.

Open online bank accountTravel emergencies

Get covered up to €1,000,000 for medical costs, up to €250 for dental costs, and up to €2,300 for emergency medical transportation while traveling.

Baggage loss and delay

Get covered up to €500 for baggage delays of over four hours, or up to €2,000 if your baggage is stolen, goes missing, or is accidentally damaged.

Travel delays

If your flight is delayed by at least two hours, you’ll get €500 in compensation — and receive €100 for each additional hour.

Trip interruption

Get covered up to €10,000 for unused non-refundable trip costs, plus additional accommodation and transportation.

Get an extra card for when you need it

Ever lost your card and had to wait days for the new one to arrive? To make your day-to-day a little bit easier, N26 You allows you to order an additional debit card to use with your personal account. This way, you’ll always have access to your cash.

Read moreCustomer Support is here for you!

Need urgent support right away? Our Customer Support team is on hand to help. Reach our specialists directly via the N26 app or the web app chat, or visit the Support Center to quickly find answers to your questions.

Visit Support Center

Explore the world with N26 You

Open your N26 You account for €9.90 per month. Get a shiny new debit Mastercard, and spend your money at home or abroad without hidden fees while enjoying an extensive insurance package.

Frequently asked questions

What are the benefits of an N26 You account?

N26 You is a premium membership bank account that comes with a colorful debit card, travel insurance and cover for flight, luggage and curtailment delays as well as luggage loss. You’ll also get exclusive partner deals and free foreign currency ATM withdrawals worldwide. See T&C’s for full details and availability.

How do I open an N26 You bank account?

To open an N26 You account, you must meet our eligibility criteria. If you do, simply register on our website, or by downloading the N26 app onto a compatible smartphone. Opening an account takes only a few minutes and is done without paperwork. Once you’ve verified your identity, your bank account will be ready to use.

For more information on opening an N26 You bank account, as well as the documents that you need, visit our Support Center.

What do I need to open an N26 You bank account?

You can open an N26 You account via the N26 app on your smartphone or the web app. You’re eligible if:

- You’re at least 18 years old

- You’re a resident of a supported country

- You have a compatible smartphone

- You don’t already have an account with us

You will also need to provide a supported ID document, applicable to the country you’re resident in. Find further information here.

How much does the N26 You bank account cost?

An N26 You bank account costs €9.90 per month.

What kind of travel insurance does the N26 You bank account offer?

N26 You comes with an extensive insurance package, provided by Allianz Assistance. This includes coverage for travel and baggage delays, baggage loss, medical coverage in case of emergencies abroad, and much more.

Do you charge foreign transaction fees?

We don’t charge an exchange rate fee if you pay with your Mastercard or withdraw cash in foreign currency.

What are the differences between the N26 You bank account and N26 Business You bank account?

N26 You is a personal account, not to be used for business purposes. In comparison, N26 Business You is a business account for freelancers and the self-employed, who also benefit from 0.1% cashback on purchases in addition to all the benefits of N26 You. At the moment, it’s only possible to hold one bank account per person with N26.

What are Spaces sub-accounts, and how can I use them?

N26 Spaces are sub-accounts that sit alongside your main account, giving you an easy way to manage your finances. As a premium customer, create up to 10 Spaces sub-accounts with IBANs in an instant, and effortlessly put money aside for your savings goals, upcoming expenses, or even an emergency fund. Of course, how you use your spaces is up to you — it’s not necessary to add an IBAN to each space if you don’t need one.

With unique IBANs for each Spaces sub-account, you can receive SEPA bank transfers and pay via direct debit — right from each space. Try using Rules to automatically set your bill money aside to a space, then pay via direct debit from your sub-account. With your monthly expenses taken care of, you can relax knowing that you won’t overspend in your main account.

If you want to save and spend as a group, simply create a Shared Space, and manage funds together with up to 10 other N26 customers. However, please note that an IBAN cannot be added to a Shared Space for now. Stay tuned for more updates to come! Find out more about Spaces and Shared Spaces here.

Does N26 offer an account switching service?

Yes — we’ve teamed up with finleap Connect to offer a free account switching service. Switch from almost any German bank the easy way by submitting a bank-switching request in just 10 minutes. Want to know if you can switch to N26 from your current bank? Visit our dedicated account switching service page and type in the name of your current bank. For more information on how to change banks easily, visit our dedicated page here.

What is an international bank account?

N26 You, our international bank account, offers numerous travel benefits and premium features. With this premium account, you’ll benefit from a comprehensive travel insurance package from Allianz, fee-free withdrawals and payments abroad, and a debit Mastercard in one of five stylish colors. You’ll also get access to innovative saving and budgeting features to easily and automatically set money aside for the goals that matter to you most. And because N26 You is 100% mobile, you’ll always have your bank in your pocket — wherever you go.

*The interest rates are based on your N26 membership: 2.8% for Standard, Smart, and You, and 4% for Metal. The interest rates are variable and subject to change in the future. Interest rates p.a. are equivalent to AER in Ireland and TANB in Portugal (before taxes).

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

***Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 You features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C.S.A - Dutch branch) one of Europe's most trusted insurance companies.

***Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 You features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C.S.A - Dutch branch) one of Europe's most trusted insurance companies.

Mastercard offers a range of complimentary privileges as part of your N26 You World card status. Every N26 You card holder is automatically entitled to enjoy these benefits, tailored to the needs of frequent travelers and globe-trotters.

If you are planning your next trip, also make sure to check out the Mastercard Priceless Cities* for exclusive events and recommendations. You only need your Mastercard to discover the most beautiful cities in the world, and your new experiences can begin.